Personal Development

Financial Responsibility and Budgeting

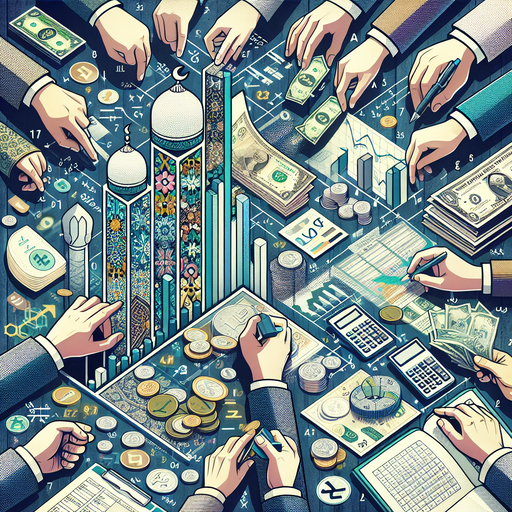

Managing Money the Islamic Way: Financial Responsibility and Budgeting in Islam

- Introduction

- Understanding Wealth in Islam

- Personal Finance and Budgeting

- Honesty and Ethics in Business

- Prohibition of Riba (Interest/Usury) and Ethical Investing

- Charity and Generosity (Zakat and Sadaqah)

- Wisdom from Scholars and Schools of Thought

- Islam’s Financial System vs. Others: Why Is It Superior?

- Miracles and Blessings of Financial Responsibility

- Conclusion: Implementing Islamic Financial Principles Today

- Recommended Books on Islamic Financial Responsibility and Budgeting ( Tradition)

Introduction

Managing money isn’t just a practical necessity—it’s a powerful part of your faith in Islam. In fact, how you handle finances profoundly shapes your success in this life and the hereafter. Financial responsibility isn’t just about personal wealth; it creates a domino effect, influencing not only your own life but also the lives of your family, community, and beyond.

Islam provides a unique roadmap for achieving lasting financial success, built on timeless values from the Qur’an and teachings of Prophet Muhammad ﷺ. Imagine a financial system that promotes honesty, moderation, and generosity, guiding you to earn through halal (permissible) means, spend wisely and without waste, invest ethically, and consistently support those in need.

In this article, we’ll journey together through Islam’s practical yet spiritually enriching guidance on finances. You’ll learn:

- How managing your money the Islamic way can dramatically improve your personal life and relationships.

- Why Islamic business ethics create lasting success, trust, and prosperity.

- What the Qur’an and authentic hadiths specifically teach about budgeting, debt, investing, and generosity.

- Remarkable stories from history illustrating Islam’s powerful financial principles in action.

- Insights from classical and modern scholars across the major Islamic schools (Hanafi, Maliki, Shafi’i, Hanbali) about money matters.

- Why Islam’s financial system isn’t just ethical—it’s logically and practically superior to alternatives.

By the end, you’ll have a clear, easy-to-follow understanding of financial responsibility in Islam, and you’ll discover exactly where to find deeper knowledge through carefully selected books.

Understanding Wealth in Islam

In Islam, wealth is viewed as a blessing and a test from Allah (God). The Arabic term rizq (رزق) means provision, something God provides for our needs. Muslims believe all our money and belongings actually belong to Allah, and we are trustees of that wealth . This means we should be grateful and humble about what we have, and use it in ways that please God. The Qur’an reminds us that humans naturally love wealth very much, but that love of money shouldn’t make us forget our values. Instead, we must balance our love of wealth with responsibility and compassion. As one hadith (saying) teaches, on the Day of Judgment each person will be asked about their money – how they earned it and how they spent it (Jami` at-Tirmidhi 2417). In other words, money is a trust: we will answer to God for whether we earned it honestly and spent it wisely.

"The feet of the slave of Allah shall not move [on Judgment Day] until he is asked about five things: ... about his wealth and how he earned it and where he spent it ..." (Prophet Muhammad ﷺ, Jami’ at-Tirmidhi, Hasan/Sahih (Jami` at-Tirmidhi 2417)

Islam does not say money is evil by itself. It’s all about how we get it and use it. Wealth can bring us closer to Allah if we earn it lawfully (halal) and spend it in good ways, like supporting our family and helping the poor . But if someone earns money through cheating or exploitation, or becomes greedy and selfish, then that wealth can lead them away from Allah. Imam Al-Ghazali, a famous 11th-century Muslim scholar, explained that love of wealth becomes bad when it makes a person stingy or arrogant, but if one uses wealth in the service of good, it becomes praiseworthy. Ultimately, Islam teaches a middle path: we neither worship money nor shun it completely; we work hard, thank God for our earnings, enjoy what is permissible, and help others.

Personal Finance and Budgeting

Islam encourages Muslims to budget wisely and live within their means. This means we should neither be extravagant nor miserly, but find a balance in spending. The Qur’an praises those who are moderate with their money:

"And [true servants of Allah] are those who, when they spend, are neither extravagant nor stingy, but hold a moderate course between those extremes." (Qur’an 25:67)

"And give the relative their rights, and also the poor and the traveler, but do not spend wastefully. Indeed, the wasteful are brothers of the devils..." (Qur’an 17:26-27)

In these verses, Allah is telling us not to squander our money on useless things (no wasteful spending!) , and also not to hoard everything selfishly. Budgeting in an Islamic sense means: first, take care of your needs and your family’s needs, then make sure to fulfill obligations like zakat (more on that later), and after that, you can enjoy permissible luxuries in moderation. A famous advice from Prophet Muhammad’s life is the saying: “Eat and drink, give charity and wear clothes, as long as no extravagance or pride is involved.” This teaches us that it’s fine to enjoy Allah’s blessings, but don’t be boastful or excessive.

One practical example of budgeting in the Qur’an comes from the story of Prophet Yusuf (Joseph). When he interpreted the Egyptian king’s dream, he advised storing surplus grain in the good years as a budget for the coming famine years (Qur’an Surah Yusuf, 12:47-49). This is essentially advice to save for the future and be financially prepared – an important part of budgeting. Islam encourages planning ahead, saving from our income without being greedy, and avoiding excessive debt.

Avoiding debt when possible is also part of responsible personal finance in Islam. While taking a loan is not forbidden (especially for genuine need), Muslims are taught to be careful with debt and pay it back promptly. The Prophet ﷺ would even pray for protection from the burden of debt, because debt can be a serious responsibility. He once refused to perform the funeral prayer for a man who died owing debt until that debt was taken care of, showing how serious it is to repay what we borrow. He said:

“Whoever takes people’s money with the intention of repaying it, Allah will repay it on his behalf; but whoever takes it in order to squander it (and not repay), Allah will destroy him.” (Prophet Muhammad ﷺ, Sahih Bukhari )

This hadith reminds us: always intend to pay back loans and never borrow just to live beyond our means. If we ever can’t repay on time due to hardship, Islam teaches that lenders should be understanding. In fact, the Qur’an highly praises those who give extra time to debtors in difficulty or even forgive the debt as charity:

"And if the debtor is in difficulty, give him time until it is easy for him to repay. But if you forgive it as charity, that is best for you, if only you knew." (Qur’an 2:280)

Being financially responsible also means providing for one’s family and not neglecting them. The Prophet ﷺ said: “The best dinar spent is one spent on your family.” He also taught that leaving your heirs well-off is better than leaving them in poverty. When his companion Sa’d ibn Abi Waqqas wanted to donate all his wealth before death, the Prophet ﷺ advised him to leave at least a third for his family, saying: “It is better to leave your heirs rich than to leave them dependent on others.” This establishes that taking care of your household expenses and saving for your family’s future is an important part of Islamic budgeting. In fact, writing a will is considered a duty if you have assets:

"It is the duty of a Muslim who has something to be given as a bequest not to let two nights pass without having his will written regarding it." (Prophet Muhammad ﷺ, Sahih Bukhari)

To summarize personal finance in Islam: earn halal, spend halal, live simply, avoid waste, pay off debts, and plan for your family. A Muslim should be mindful of where every dollar comes from and where it goes. The Prophet ﷺ warned there will come a time when people won’t care if their money is from halal or haram (forbidden) sources – we should strive not to be like those people. Instead, we care very much that our income is honest and our spending pleases Allah. This mindset brings barakah – a special blessing that makes our wealth more beneficial even if it’s small. Many Muslims can share personal stories of how sticking to a budget, avoiding extravagance, and giving charity brought peace and blessings into their lives.

Honesty and Ethics in Business

Islamic teachings on finance go beyond personal budgeting – they extend to business ethics and commerce. The Prophet Muhammad ﷺ, even before he became a prophet, was a trustworthy merchant known as al-Amīn (“the Trustworthy”). Islam holds honesty in trade as a fundamental value. Cheating or deceit in business is strictly forbidden. The Prophet ﷺ said:

“He who cheats us is not one of us.” (Prophet Muhammad ﷺ) (Sunan Ibn Majah 2224)

In one incident, the Prophet came upon a merchant who was hiding wet grain under dry grain to sell it as all dry. The Prophet ﷺ said “Whoever cheats is not one of us”, making it clear that fraud has no place in Islam Sunan Ibn Majah 2224). This applies to all business dealings – whether you run a store, work in an office, or sell things online, a Muslim must be truthful about the product or service. Selling defective products as if they’re good, lying in advertising, or breaking promises to customers would all violate Islamic ethics.

The Qur’an also addresses fair business practices. One verse says:

"O you who believe! Do not consume one another’s wealth unjustly, but trade by mutual consent." (Qur’an 4:29)

This means all parties in a business deal should agree freely and not be forced or tricked. Another set of verses warns traders about dishonest measurements:

"Woe to those who give less [than due], who demand full measure [from others] but when they measure or weigh for others, they give less." (Qur’an 83:1-3)

In the marketplace of Medina, the Prophet ﷺ established principles of justice: weights and measures had to be accurate, and any form of bribery or bribing officials (which is another form of cheating) was cursed. To ensure transparency, Islam even encourages writing down contracts. The longest verse in the Qur’an (2:282) instructs believers to write down debt contracts with witnesses, so there’s no dispute later. This shows the emphasis on clarity and honesty in financial transactions – basically, get it in writing!

Islamic business ethics also promote fair wages and workers’ rights. The Prophet ﷺ said to pay workers before their sweat dries, meaning promptly and fairly. Taking someone’s due or delaying pay without reason is considered a form of injustice. All schools of Islamic law agree on the core of these values: trustworthiness, truthfulness, and justice in all money matters. They might have minor differences in some contract details, but on cheating, theft, and dishonesty being haram (forbidden), there is no disagreement.

Another beautiful teaching: the Prophet ﷺ said “The truthful and trustworthy businessman will be in the company of the Prophets, saints, and martyrs on the Day of Judgment” (reported in Tirmidhi). Imagine – simply being an honest businessperson can earn such a reward! This highlights how much Islam values integrity in commerce. Conversely, those who devour wealth unjustly, as the Qur’an phrases it, earn Allah’s anger. There’s a strong warning in the Qur’an for people who hoard wealth or steal others’ property:

"Those who devour the wealth of people unjustly ... and those who hoard gold and silver and do not spend it in the way of Allah – give them tidings of a painful punishment." (Qur’an 9:34)

Thus, a Muslim businessperson is expected to uphold high ethics: be honest in quality and pricing, avoid interest-based dealings (discussed next), keep contracts, pay zakat on business assets, and treat employees and customers kindly. Many early Muslims were successful traders (like the companions Abu Bakr, Umar, Uthman, Khadija, etc.) because of their reputation for honesty. This shows that being ethical is not only good for the soul but also good for business – people trust and prefer honest traders.

Prohibition of Riba (Interest/Usury) and Ethical Investing

One of the most distinguishing features of Islamic finance is the complete prohibition of riba. Riba (ربا) is an Arabic word meaning increase or excess, often translated as usury or interest – essentially, an unjust, guaranteed increase in a loan or exchange. In simpler terms, charging or paying interest on loans is not allowed in Islam. This might sound surprising in today’s world where interest is everywhere (banks, credit cards, etc.), but Islam has very strong reasons for forbidding it.

Theologically, riba is considered a grave sin in Islam. The Qur’an is very blunt about it. It says:

"Those who consume usury (interest) will not stand [on Judgment Day] except like one controlled by Satan’s touch... That is because they say, 'Trade is just like interest.' But Allah has permitted trade and forbidden interest." (Qur’an 2:275)

"O you who believe, fear Allah and give up what remains due of interest, if you are truly believers. If you do not, then be informed of war from Allah and His Messenger." (Qur’an 2:278-279)

These are very powerful words – “war from Allah and His Messenger”! No other sin in the Qur’an is described in that way. It shows how harmful riba is in the sight of Allah. Another verse contrasts how Allah deals with charity versus interest:

"Allah will deprive usury of all blessing, but will give increase for deeds of charity." (Qur’an 2:276)

In other words, money gained from interest has no blessings, while money given in charity multiplies in blessing. The Prophet Muhammad ﷺ also cursed the practice of riba in very clear terms:

“Allah’s Messenger ﷺ cursed the accepter of interest, its payer, the one who records it, and the two witnesses; and he said: They are all equal [in sin].” (Sahih Muslim )

So, every party involved in an interest-based deal earns sin. All four schools (Hanafi, Shafi’i, Maliki, Hanbali) unanimously agree that riba is haram. There was never any debate that charging interest on loans is forbidden – it’s considered one of the major sins in Islam (called kabā’ir).

Why such a strict stance? Islam teaches that interest creates injustice and exploitation. When the rich lend to the poor with interest, the rich risk nothing and guarantee more wealth, while the poor shoulder all the risk and get trapped in debt. Over time, this widens the gap between rich and poor, leading to inequality . Modern economists note the same: interest-based systems can lead to cycles of debt, poverty, and crises. By banning riba, Islam encourages a system where money is invested in real business and trade, not just loaned for a profit. One Islamic finance source explains that in Islam, financial transactions should be fair exchanges with no party exploiting the other .

Instead of interest, Islam promotes ethical investing and profit-sharing. If you have money to invest, you shouldn’t exploit someone who needs a loan; rather, you can partner with them. For example, Islamic banks use modes like musharakah (partnership) or mudarabah (investor provides capital, entrepreneur provides work, and they share profits). In a business partnership, both share risk and reward – this is just and encourages cooperation. Another common Islamic finance tool is murabaha, where a bank buys an item and sells it to the customer at a marked-up price (disclosed upfront), allowing profit without interest . These methods ensure money is tied to real assets and actual commerce.

Importantly, an Islamic investor must also avoid putting money into haram industries (like alcohol, gambling, pork, etc.). This makes sure investments are ethical and socially responsible. All this may sound complicated, but it has modern applications: Today, there are over 500 Islamic banks and financial institutions worldwide operating without interest. They still turn profits through halal means. In fact, avoiding riba hasn’t hampered their operations – Islamic banks are often well-capitalized and were relatively stable even during financial crises . This suggests that the Islamic financial system can be just as viable, and arguably more stable, than conventional finance.

It’s worth noting that classical scholars wrote extensively on economic justice. For instance, Imam Abu Hanifa’s student, Qadi Abu Yusuf, wrote Kitab al-Kharaj 1200 years ago about fair taxation and public spending. Scholars like Imam Malik and Imam Shafi’i discussed equitable trade practices. They all saw riba as a source of injustice. Some differences in schools do exist in fine points: for example, what constitutes riba in trade items (like exchanging gold for gold must be equal, etc.). They debated technical details like barter rules or modern issues (some contemporary scholars discuss if adjusting loans for inflation is allowed). But these are details – the core prohibition of unjust, exploitative gain is agreed upon.

In summary, Islam’s stance on interest and investing can be summed up in a bold principle: Money should be a tool to facilitate trade and help each other, not a tool to exploit others or grow wealth unjustly. If Muslims avoid riba and invest in halal ways, they believe their wealth will have barakah (blessing), even if the growth seems slower. They trust Allah’s promise that interest-bearing wealth has no future, while shared risk and charity lead to true prosperity. As the Qur’an says, “Allah increases charity.” And as a hadith states:

“Charity does not decrease wealth.” (Prophet Muhammad ﷺ, Sahih Muslim)

Believe it or not, giving away money for the sake of Allah actually increases your blessings and often your wealth in unexpected ways! This leads us to the next big topic: generosity.

Charity and Generosity (Zakat and Sadaqah)

One of the pillars of Islam is Zakat (زكاة), which is an obligatory charity. Every year, Muslims who have savings above a certain minimum (called nisab) must give about 2.5% of their saved wealth to the poor and needy. Zakat literally means “purification”, because Muslims believe giving zakat purifies your wealth and soul. The Quran orders Muslims to establish prayer and give zakat:

"Establish prayer and give Zakat." (Qur’an 98:5)

Zakat is not a tax forced by the state (though in Islamic governance it can be managed by the state); rather, it’s seen as a religious duty and an act of worship. It’s amazing to think that the money we consider “ours” has a portion that actually belongs to the poor – by giving it, we are just delivering it to its rightful place. The Qur’an (9:60) even specifies categories of people who can receive zakat, including the poor, the needy, those in debt, and so on, ensuring that wealth circulates to help society.

Beyond zakat, Islam greatly encourages sadaqah, which means voluntary charity or generosity. Any good deed of giving – whether it’s money, food, a kind word, or even a smile – is considered sadaqah. The Prophet Muhammad ﷺ was extraordinarily generous; it’s said he was more generous than the blowing wind in giving freely to others. He taught us that charity never makes you poorer; it only increases you in goodness. He said: “Wealth is not diminished by charity.” And the Qur’an uses beautiful imagery to encourage generosity:

“The example of those who spend their wealth in the cause of Allah is like a grain that grows seven ears, in each ear a hundred grains. Allah multiplies [reward] for whom He wills...” (Qur’an 2:261)

Imagine a single seed turning into 700 (7 ears x 100 grains)! Allah is telling us that when you give for His sake, He will multiply your reward and maybe even your wealth in other ways. Another verse says those who give privately and openly will have their reward with their Lord and no fear (2:274). Muslims often give sadaqah secretly to avoid showing off, but they also give openly at times to encourage others. Both are good.

Generosity in Islam isn’t just about money either – it’s a whole attitude of caring for others. The Prophet ﷺ said: “He is not a true believer whose stomach is full while his neighbor goes hungry.” This instills a sense of social responsibility. Even a smile or helping hand is considered charity. But of course, financial generosity has huge benefits. One hadith highlights that being kind to those in need carries the reward of continuous worship:

“Anyone who looks after and works for a widow or a poor person is like a warrior fighting for Allah’s cause, or like someone who fasts all day and prays all night.” (Prophet Muhammad ﷺ, Sahih Bukhari)

We also see the sahaba (Companions of the Prophet) setting examples in generosity. The caliph Abu Bakr donated almost all his wealth on one occasion to help the community, and when asked what he left for his family, he said, “I left them Allah and His Messenger.” `Umar donated half of his wealth that day – they were competing in charity! Another companion, Uthman, bought a well and donated it to public when water was scarce in Medina, and also financed an entire army expedition with his wealth – these acts earned him the Prophet’s praise and Allah’s pleasure.

Islamic history is full of waqf (endowments) – charitable trusts that funded schools, hospitals, water wells, and soup kitchens for centuries. This was possible because Muslims took seriously the teaching that wealth should circulate and not just remain in a few hands . Allah says in the Qur’an that we should give from what we love (Qur’an 3:92) and that we will find it with Him. There’s even a promise that whatever you give, Allah replaces it: “Whatever you give in charity, He [Allah] will replace it. He is the Best of Providers” (Qur’an 34:39).

To illustrate how Allah can put barakah (divine blessing) in the wealth of the generous, there are some awe-inspiring stories. In the time of the Prophet ﷺ, during the Battle of the Trench, the Muslims were hungry and had very little food. A companion named Jabir had only a small amount of barley and a young goat to cook – enough for maybe a few people. The Prophet ﷺ prayed over the food and told him to invite everyone in the camp (which was about a thousand soldiers!). Miraculously, all thousand people ate to their fill from that little meal, and the pots were still full! Jabir himself reported:

“On that day, about a thousand people ate from four handfuls of rye bread and a young cooked goat; yet food was still left over... After the one thousand people had left, the pot was still boiling with meat in it, and bread was still being made from the dough – for the Prophet had blessed them.”

This true story, witnessed by many, shows the unbelievable barakah that generosity can invite. It’s as if Allah was showing, “You feed others for My sake, and I will feed multitudes on your behalf.” While that is a miracle from the prophetic era, even today many Muslims will tell you that when they give charity, somehow their finances don’t suffer – in fact, they often gain more, or at least find greater contentment. The Prophet ﷺ taught that when we give, two angels pray for us – one says “O Allah, give the giver something in exchange!” and the other says “O Allah, give the miser destruction!” . So we truly believe giving opens the doors of heaven’s blessings.

It’s also important to give wisely – Islam encourages giving to the most deserving. Zakat, for example, has to go to certain categories (poor, orphans, those in debt, etc.). Voluntary charity can be to anyone or any good cause. Helping family in need counts as both charity and maintaining kinship – double reward. The Prophet ﷺ said “the upper hand is better than the lower hand”, meaning the giving hand is better than the receiving hand, and advised, “start with those who are under your care” (family) . So being generous doesn’t mean neglecting your dependents; it means after taking care of your own, you reach out to others.

The balance is key: Muslims should neither be miserly (Islam considers extreme stinginess a disease of the heart) nor irresponsible in giving (Islam doesn’t want you to give so much you leave yourself or your family in hardship). The Qur’an says not to “cast yourselves into ruin with your own hands” (2:195) – so we give within our capacity. The Prophet ﷺ once met a man who had given away all his property as charity, and the Prophet gently rebuked him, pointing out that he should have kept some for himself and his family. This shows Islam’s practical wisdom: be generous, but also be responsible.

In classical scholarship, generosity (karam) is considered a virtue that perfects a person. Scholars like Imam Al-Ghazali wrote about finding the middle between miserliness and reckless extravagance. They encouraged training oneself to give, even if initially it feels hard, until generosity becomes natural.

All four major schools encourage regular charity and have detailed laws on zakat calculation. There are slight differences – for example, the Hanafi school requires zakat on women’s jewelry if it’s above the nisab (minimum amount), whereas Shafi’i, Maliki, and Hanbali schools generally say personal jewelry is exempt from zakat. This difference comes from various interpretations of hadith. But they all agree on the spirit: excess wealth should benefit society, and no one should be left starving in an Islamic community. Another area of difference is how zakat is given on agricultural produce or business goods, with varying rates and thresholds, but again the idea is wealth of all types must “give back” to those less fortunate.

Wisdom from Scholars and Schools of Thought

Islamic teachings on finance have been elucidated by scholars for over a thousand years. Classical scholars often combined deep spirituality with practical advice on money. For instance, Imam Muhammad al-Shaybani (a student of Abu Hanifa) wrote Kitab al-Kasb (“The Book of Earning a Livelihood”) around 8th century, where he explained that working hard to earn permissible income is a duty, and he outlined ethics of spending and charity. He even talked about budgeting – advising people to prioritize necessities, then useful expenditures, and avoid excess.

Imam Al-Ghazali (11th century) in his famous Ihya’ Ulum al-Din wrote that wealth is like a snake with venom (dangers) but also with medicine, meaning it can be dangerous if loved for itself, but it can also be very beneficial if used for good. He stressed that the only reason to desire money should be to spend it in righteous ways; otherwise it just chains the heart. He and other scholars warned against miserliness, quoting the Prophet’s saying that miserliness and faith cannot coexist in a true believer’s heart . At the same time, they praised those who are self-sufficient and not constantly asking others for help. The Prophet ﷺ taught us to seek refuge from debt and from poverty, implying Muslims should strive for a dignified financial independence, yet also rely on Allah and be content with what they have.

When it comes to differences among the major madhhabs (schools of law), the fundamental principles remain the same, but there are nuanced discussions. We mentioned zakat on jewelry (Hanafis vs others). Another example: some schools historically debated certain transactions that could be used to circumvent interest. The Shafi’i school, for example, traditionally allowed a contract called bay’ al-‘inah (a kind of trade that could be abused to mimic a loan with interest) if each step is technically lawful, whereas Maliki and Hanbali scholars strongly discouraged it, prioritizing the spirit of the law (to avoid riba in all but name). This was a debate on legal technique, but all agreed they must avoid actual riba.

In modern times, contemporary scholars like Mufti Taqi Usmani and Sheikh Yusuf al-Qaradawi have written extensively to show how Islamic finance can work today – from banking without interest to sukuk (Islamic bonds) and microfinance. They argue that the Islamic approach, if applied, leads to more equitable distribution of wealth and prevents many of the crises of the conventional system . For example, they point out that the 2008 financial crisis was fueled by interest-bearing debt and speculative instruments not backed by real assets – things that Shariah forbids. Islamic banks, which avoided those toxic assets, fared relatively better.

economists like Dr. Muhammad Umer Chapra and M. A. Mannan have also provided philosophical arguments: Islam’s system ties the economy to real human welfare (since zakat directly helps the poor, and bans on interest and gambling prevent exploitation and reckless risk), making it ethically superior. They also note it encourages entrepreneurship and risk-sharing. Instead of a culture of credit cards and living beyond means, Islam promotes saving up or profit-sharing investments. Logically, this avoids the trap of interest which can accumulate beyond a person’s ability to pay, leading to personal bankruptcies or worse (we see this in payday loans or credit card debt today).

The concept of barakah is something economists might not measure, but many Muslims swear by it: If you manage money the halal way, somehow it goes further and brings more benefit than an equal amount of haram money. There’s a famous hadith Qudsi (a saying of Allah via the Prophet) where Allah says: “O Son of Adam, spend (in charity) and I will spend on you.” This indicates that Allah takes care of those who are generous. Indeed, history has examples of unbelievably wealthy Muslim societies (like in early Andalusia or Abbasid times) where endowments eliminated poverty – a result of widespread charity and circulation of wealth.

Islam’s Financial System vs. Others: Why Is It Superior?

After seeing all these principles – honesty, no interest, obligatory charity, ethical investing, moderation – one might ask, how do these compare to other systems? From an Islamic perspective, a financial system based on these divine principles is superior both theologically and practically. Let’s break it down:

Theological Superiority: For Muslims, the primary reason the Islamic financial system is best is because it’s ordained by Allah. Following it is an act of worship and obedience. Muslims believe Allah, our Creator, knows what system is healthiest for us individually and collectively. So even if at times the Islamic way seems hard (for example, avoiding interest when everyone else uses it), believers trust that God’s commands bring goodness. The sense of fulfilling a religious duty means even mundane acts like budgeting or cancelling an interest-bearing credit card become meaningful – you do it to seek Allah’s pleasure. Other systems lack this spiritual dimension. Capitalism or socialism, for instance, are human-devised; they might have good points but aren’t sacred. Islam sacralizes economic justice – making it part of one’s path to Paradise. For example, giving zakat is not just a tax, it’s a pillar of Islam (like prayer and fasting); neglecting it is actually sinful. No secular system can motivate charity in this powerful way.

Moral and Logical Superiority: Islam’s financial system centers on justice and compassion, whereas conventional systems often center on profit and growth even at the expense of ethics. Consider interest vs. profit-sharing: interest guarantees the lender profit regardless of the borrower’s situation – this can lead to injustice (as we discussed, rich get richer, poor get poorer ). In profit-sharing, the lender (investor) only profits if the venture succeeds, which is fair. It naturally encourages the investor to support the borrower (since they’re partners). In a way, Islamic finance aligns incentives correctly: people help each other succeed. Conventional finance sometimes misaligns incentives (e.g., a bank may benefit more if you keep paying interest for longer). Islam closes the door to that by outlawing riba.

Additionally, Islam forbids gharar, which means excessive uncertainty or deception in contracts (like very risky speculative transactions). This reduces the kind of wild speculation that can crash markets. Think of the 2008 derivatives mess – Islamic rules against gharar would have prevented selling confusing debt packages in the first place. So logically, the Islamic system tends to be more stable and transparent.

Philosophically, Islam sees wealth as a means to good, not an end in itself. Other systems, particularly materialistic capitalism, often elevate wealth accumulation as a goal of life. That can lead to greed being normalized (“Greed is good” as some say). Islam fundamentally disagrees – greed that harms others is evil. The Qur’an strongly criticizes those who accumulate and brag about wealth (see Qur’an 104:1-3). Instead, Islam encourages contentment. The Prophet ﷺ said, “True richness is the richness of the soul.” This philosophy can create a healthier society: less anxiety over keeping up with the Joneses, more focus on community well-being. Contrast that with consumerist culture which often leads to stress, debt, and an emptiness people try to fill with more shopping. The Islamic system, if practiced, encourages a fulfilling cycle: earn honestly, spend on needs, help others, be content – which leads to a more balanced life.

Social Superiority: Islam basically built charity into the system (through zakat and encouragement of sadaqah) rather than leaving it optional. This ensures a constant flow of wealth to the poorer segments. In a way, it’s like a continuous moral redistribution that doesn’t rely on government welfare alone but on personal responsibility and piety. Other systems either rely purely on state taxes/welfare (which can be bureaucratic and impersonal) or on individual charity which may or may not happen. The Islamic duty of zakat and virtue of sadaqah create a strong social safety net powered by faith. Historically, travelers in the Muslim world found free inns (funded by waqf), the poor could eat from soup kitchens, and education was often free due to these endowments. This was because wealthy individuals felt accountable to God to spend their wealth for public benefit.

The Islamic approach also eliminates harmful earnings: not just interest, but things like gambling and selling harmful products are forbidden. Gambling (maysir) is another cause of financial ruin for many, and Islam nips it in the bud. The logic is that money should be earned by productive effort or beneficial trade, not by chance or exploitation. When Muslims avoid these things, their communities avoid the plagues of addiction, bankruptcies from gambling, and other social ills. It’s a more holistic ethical economy.

Accountability and Barakah: Because Muslims believe they will answer to Allah for every penny, there is an in-built accountability that no secular law can enforce. Someone might hide income from the taxman, but they know they can’t hide it from God. This ideally ensures sincerity and honesty even when no one is watching – something alternative systems struggle with (since people often try to cheat systems if they can get away with it). Also, as previously mentioned, Muslims seek barakah – a concept absent in other systems. We believe that sometimes a smaller, halal profit is far better than a large, haram profit that has no blessing. There are many anecdotes where unethical riches lead to misery, whereas ethical earnings, though modest, lead to happiness. This belief encourages patience, integrity, and trust in Allah rather than cutthroat competition.

To be fair, not every Muslim or Muslim country today perfectly follows these ideals. The modern global economy is interwoven with interest and other non-Islamic practices, which presents challenges. But there’s a growing movement towards Islamic banking, ethical investing, microfinance based on interest-free loans, etc. When Muslims have implemented their principles even partially, the results are encouraging. For example, during the recent COVID-19 economic downturn, some Islamic funds avoided major losses because they weren’t invested in highly leveraged (debt-heavy) companies. And microloan programs that lend without interest (qard hassan loans) have had high repayment rates and community support, because borrowers feel moral duty to repay.

In summary, Islam’s financial system is seen as superior because it aims for moral economics – where justice, charity, and responsibility take priority. It’s not solely about profit; it’s about purposed profit (profit that’s halal and shared) and overall prosperity of society with a clean conscience. As Allah said in the Qur’an:

“Whatever you give in interest to increase people’s wealth does not increase with Allah. But whatever you give in charity, seeking the pleasure of Allah – it is they who will get a multiple reward.” (Qur’an 30:39)

This verse captures it well: only the gains that are just and charitable count in the long run.

Miracles and Blessings of Financial Responsibility

Throughout Islamic history, there are inspiring stories that underscore the miraculous benefits of following these financial principles. We already recounted the miracle of abundance during the Battle of the Trench where charity and trust in Allah led to an entire army being fed . Another famous example involves Jabir ibn Abdullah (the same companion). After Jabir’s father died, Jabir was left with a lot of debt and not enough assets to pay it off. The Prophet ﷺ helped Jabir by praying for barakah over his dates in his orchard. When Jabir went to measure and harvest the dates, he found that he was able to pay off all the debt and still have dates left over, something mathematically almost impossible . This was a miracle showing that if you are sincere and ask Allah’s help while being responsible, Allah can make the impossible happen – in this case, making a limited resource stretch unbelievably.

There are also everyday “miracles” Muslims experience, like finding that when they start giving more charity, suddenly they feel no lack of money. It’s hard to explain, but many will tell you their wealth somehow goes further, unexpected opportunities or refunds come, or simply they feel happier and less in need of material things. As the Prophet ﷺ conveyed from Allah: “Spend, [on charity] O son of Adam, and I will spend on you” – this divine promise often manifests in remarkable ways.

Some stories border on the miraculous: for example, it’s narrated that once a poor man came to the Prophet asking for food for his kids. The Prophet ﷺ had no food at that moment, so he got a piece of iron from the man, sold it for some money, bought an axe for the man and told him to gather firewood and sell it. In two weeks, the man earned enough to feed his family and even buy clothes. This was not a direct “miracle” like food multiplying, but it shows the Prophet’s wisdom in helping someone become self-sufficient – a small capital (axe) plus hard work and trust in Allah turned the man’s situation around. The Prophet then commented that this was better for the man than begging (which is only allowed in dire need). The miracle here is the transformation that Islamic guidance can bring: from poverty to productivity.

Another charming hadith: “The food for two people suffices three, and the food for three suffices four” (Muslim). When people share and are generous, somehow everyone is satisfied even if mathematically it seems not enough. This is the barakah Allah puts in shared meals and resources. Many families witness that a small income manages to raise many children successfully when there is barakah, whereas a huge income might get wasted if there is no barakah.

All these instances strengthen a Muslim’s faith that being financially responsible and generous as Islam teaches will never make you lose out. Even if initially one fears, “If I give this much in charity, will I have enough?”, the belief is Allah will replace it with something better . It’s a bit like a miracle of the heart: once you start giving, greed and fear melt away, replaced by contentment and trust. That itself is a gift from Allah.

Conclusion: Implementing Islamic Financial Principles Today

In today’s world, Muslims face new challenges: consumer culture pushes people to spend more than they have, easy credit lures many into interest-based debt, and businesses often prioritize profit over ethics. How can Muslims apply the beautiful principles of Islam in such times? The good news is that these teachings are timeless and adaptable. To move forward:

Education is key. Muslim communities and families should talk more about financial responsibility as part of their religious learning. Just as we teach how to pray, we should teach youth how to budget, save, and give charity for the sake of Allah. Knowing the verses and hadiths (like those we quoted) helps strengthen our resolve to follow them. For example, remembering “the wasteful are brothers of the devils” can make one think twice about extravagant purchases. Knowing that “whoever cheats is not one of us” (Sunan Ibn Majah 2224) can encourage a young entrepreneur to stay honest even if others cut corners.

Personal Finance Discipline. Every Muslim can start implementing a simple Islamic budget: calculate your zakat yearly and pay it (there are apps and guides to help). Set aside a portion for sadaqah regularly, even if small – this purifies the rest of your money. Avoid interest-bearing loans: for needs like a house or car, look for Islamic financing options (many countries have them now) or try to save and pay as much up front as possible. If you have interest-based accounts, consider switching to non-interest or Islamic bank accounts if available, or at least do not intend to use interest and give any earned interest away to charity (since it’s not considered your money to keep). Living debt-free is a great feeling; Islam encourages it. So, if you have debts, make a plan to pay them down. If you need to borrow, keep it halal and reasonable.

Business and Work Ethics. Muslims in business should realize their work is a form of worship when done right. By being the honest trader or ethical professional, you are showcasing Islam’s values. In the long run, this builds trust and a strong brand – so it’s win-win spiritually and financially. Organizations can adopt Islamic finance principles by avoiding interest-based financing and instead using profit-sharing with investors or simple loan structures. If you’re an employer, pay fair wages and treat employees well; if you’re an employee, give an honest day’s work for your pay. Basically, embed ihsan (excellence and conscience) in your economic activities.

Supporting Islamic Economic Institutions. To change the broader system, Muslims can support and patronize Islamic banks, credit unions, and financial products that align with Shariah. The more we use them, the more they’ll grow and improve. There are also charities that give qard hasan (zero-interest loans) to help people in need – donating to or volunteering with such causes revives the Sunnah of interest-free benevolence. In majority-Muslim countries, pushing for policies that implement zakat collection, anti-usury laws, or waqf development can gradually islamicize the economy. In non-Muslim countries, Muslims can still create micro-societies of these principles (like local halal investment groups, cooperatives, etc.).

Balance and Moderation in Modern Life. Islam doesn’t ask us all to be paupers or millionaires – it asks us to be balanced and God-conscious with whatever we have. A millionaire can be beloved to Allah if he’s humble, honest, and hugely generous. A poor person can be sinful if he’s greedy or cheats, and vice versa. It’s not the amount in the bank, it’s the values in the heart and actions. So, Muslims today should neither overly chase dunya (worldly wealth) at the expense of religion, nor ignore financial planning thinking that’s piety. The Prophet ﷺ taught people to tie their camel and trust in Allah – meaning do your due diligence in money matters but rely on Allah for the outcomes. We should strive for financial stability so we are not a burden on others (even aiming to be the ones giving, not receiving aid), yet our ultimate trust and reliance (tawakkul) is in Allah, not in the dollar.

Facing modern riba: It’s true that completely avoiding interest is challenging (for example, even holding cash in some countries involves implicit interest via inflation, etc). Scholars have given fatwas in some cases of necessity (darura) to tolerate certain things temporarily if no halal alternative exists. But as much as possible, a conscious Muslim will minimize involvement with riba. For instance, one might rent instead of an interest mortgage, or use Islamic finance, or take smallest loan and pay off quickly. Each person should assess their situation with knowledge and possibly consult a scholar for tough issues. The awareness itself has grown – 50 years ago, few alternatives existed; now Islamic finance is a whole industry. So the community is moving forward, and inshaAllah one day interest-based banking might even be obsolete if Islamic models prove more equitable and resilient.

Finally, these Islamic financial principles are not just for Muslims; they offer wisdom for everyone. Concepts like ethical investing, microfinance, caring for the needy, and avoiding predatory lending are universally beneficial. By living these principles, Muslims also set a positive example and contribute to a fairer economy for all.

The bottom line for Muslims today is: we should reconnect with our rich heritage of financial wisdom in the Qur’an and Sunnah. Whether it’s making a budget, choosing a career, running a company, or donating to charity, let’s infuse those actions with Islamic values. This way, we earn Allah’s blessings in our wealth and ensure our money truly benefits us in this life and the next. When we manage our money the Islamic way, we’re not just doing accounting – we’re doing accountability to Allah. And that brings a sense of peace and purpose no conventional finance seminar can give!

Recommended Books on Islamic Financial Responsibility and Budgeting ( Tradition)

For further reading, here are some mainstream, highly-regarded works (classical and modern) that delve into Islam’s teachings on finance, ethics, and wealth management:

- Kitab al-Amwal (“The Book of Wealth”) – Abu Ubayd al-Qasim ibn Sallam. (Classical) A comprehensive 9th-century collection of Qur’an and hadith texts on public finance, charity, taxation, and economic ethics in early Islam.

- Kitab al-Kharaj (“The Book of Taxation”) – Imam Abu Yusuf. (Classical) An early Islamic treatise for the Abbasid Caliph on taxation, public spending, and economic justice according to Islamic law.

- Kitab al-Kasb (“The Book of Earning a Livelihood”) – Imam Muhammad al-Shaybani. (Classical) Guidance from a prominent 8th-century jurist on how to earn and spend money in a halal manner, balancing worship and worldly effort.

- Ihya’ Ulum al-Din (particularly the sections “Kitab Adab al-Kasb” on earning and “Kitab al-Zakat” on charity) – Imam Abu Hamid al-Ghazali. (Classical) A profound work linking spirituality with daily life, including deep insights on love of wealth, generosity, and contentment.

- Fiqh az-Zakat – Sheikh Yusuf al-Qaradawi. (Modern) A two-volume detailed study on the jurisprudence of zakat (obligatory charity), discussing its objectives, calculations, and impact on society, with references to classical scholars.

- An Introduction to Islamic Finance – Mufti Muhammad Taqi Usmani. (Modern) A beginner-friendly book by a leading contemporary scholar, explaining the principles of Islamic banking, prohibition of interest, and allowed contracts, with real-world applications.

- Islam and the Economic Challenge – Dr. Muhammad Umer Chapra. (Modern) An insightful analysis by a renowned economist on how Islamic economics can address modern issues like inequality, stability, and moral decline, comparing Islamic and conventional systems.